Village Tax Information

IMPORTANT INFORMATION!

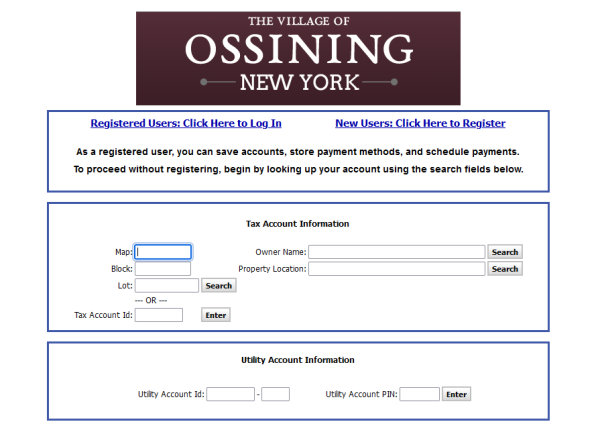

**If you are making an online Water payment, please make sure your using the following URL: https://wipp.edmundsassoc.com/Wipp/?wippid=OSNV and the page has the above image. This will ensure you're using the Village of Ossining approved payment vendor**

Village real property taxes are collected by the Village of Ossining Finance Department. The first installment of Village Taxes is due without penalty by January 31, 2023. The second installment of Village property taxes is due without penalty by July 31, 2023. Tax payments should be made payable to the “Village of Ossining” and mailed to the following address:

Village of Ossining

Finance Department 2nd Floor

16 Croton Avenue

Ossining, NY 10562

Office hours are Monday through Friday, 9:00 am until 4:30 pm

Payments by e-check or credit card can be made on our web site. There is a non-refundable fee of 3% for credit cards and $1.50 for using eChecks. NY State Law requires municipalities to pass these fees on to the consumer for tax payments. The amount of the fee will be stated separately for your review before you pay the bill.

To find your bill, it is only necessary to enter 5 letters of your last name and 5 letters of your street name (no house numbers, please).

When mailing taxes in the last few days of the month in which they are due, make certain that you witness a “Timely Official United States Postmark” being affixed to the envelope. Effective January 2003, U.S. Postal Service, Airborne Express, UPS, Fed Ex or DHL World Wide Express are acceptable forms of timely postmarks. Postage meters (i.e. Pitney Bowes) and foreign postmarks are NOT accepted. Where an envelope containing payment of local taxes has no acceptable Postmark date, payment of such taxes is deemed to have been made on the date the payment is received.

New York State Law provides that the Village Treasurer CANNOT waive penalties on real estate taxes received after the due date FOR ANY REASON.